By: God’spower Samuel

Tuesday, November 12, 2024

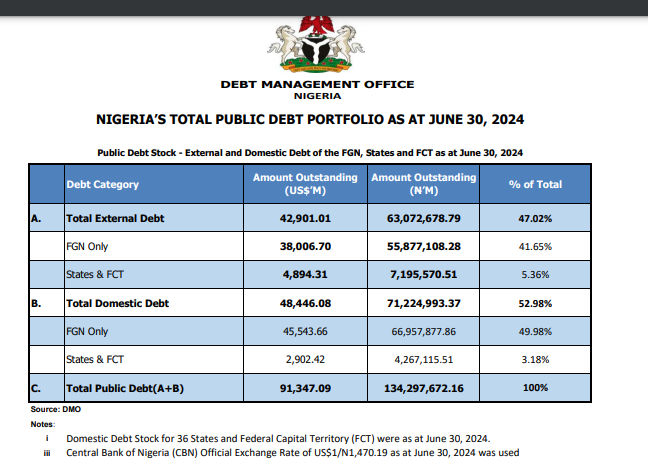

According to the latest report from the nation’s Debt Management Office (DMO), the debt of Nigeria’s 36 states and the Federal Capital Territory (FCT) rose to N11.47 trillion by June 2024, a 14.57% increase from the previous N10.01 trillion recorded in December 2023. This ongoing debt escalation shows mounting concerns about fiscal sustainability at national and subnational levels.

Debt Growth Since President Tinubu’s Inauguration

A review by Starreporters, of the Debt Management Office (DMO) data highlights that Nigeria’s total public debt has expanded by approximately N46.9 trillion since President Bola Tinubu took office. At the beginning of his tenure in June 2023, the national debt stood at N87.3 trillion. Within a year, by June 2024, it had surged to N134.2 trillion.

This leap reflects both exchange rate fluctuations and new borrowing to support budgetary needs. As DMO Director-General Patience Oniha explains, “the rise in Nigeria’s public debt stock … is partly due to exchange rate fluctuations” and the “securitisation of N4.90 trillion as part of the N7.3 trillion Ways and Means Advances approved by the National Assembly.” This consolidation of government loans, she notes, has been a substantial contributor to the debt increase.

“the rise in Nigeria’s public debt stock … is partly due to exchange rate fluctuations” and the “securitisation of N4.90 trillion as part of the N7.3 trillion Ways and Means Advances approved by the National Assembly.”

DMO Director-General Patience Oniha

Quarterly Borrowing Activity

Breaking down recent debt increments, Nigeria’s debt grew from N87.3 trillion in June 2023 to N87.9 trillion by September 2023, signifying an additional N600 billion borrowed within the three months. This aligns with the DMO’s efforts to address budgetary gaps through new domestic and external loans.

According to the DMO, external debt for states and the FCT increased from $4.61 billion to $4.89 billion in the first half of 2024. However, the naira’s devaluation has magnified the local currency value of these loans by 73.46%, taking it from N4.15 trillion to N7.2 trillion. Despite this rise in external liabilities, domestic debt showed a modest decrease from N5.86 trillion to N4.27 trillion, offering a slight reprieve to state budgets amid the prevailing fiscal pressures.

State-Level Debt and Revenue Challenges

The DMO’s latest report also reveals that the combined domestic debt of states and the FCT increased by 5%, reaching N4.27 trillion by June 2024, compared to N4.07 trillion in March. Starreporters also noted varied debt levels across states, with some experiencing significant increases while others showed marginal adjustments or even reductions.

This fiscal dependency on federal allocations remains substantial, as BudgIT reported that 32 states relied on the Federal Accounts Allocation Committee (FAAC) for over 55% of their revenue in 2023. The Gross FAAC allocation itself rose by 33.19%, from N4.06 trillion in 2022 to N5.4 trillion in 2023, due to increased oil revenue. However, experts warn that this heavy reliance on federal revenue exposes states to economic volatility, especially with shifting oil market conditions.

Moving forward, economists caution that without significant revenue diversification and fiscal responsibility, states and the country may struggle to maintain financial stability. As the Debt Management Office (DMO) puts it, a strengthened focus on boosting “Internally Generated Revenue (IGR) remains essential for states seeking to reduce their dependence on fluctuating federal distributions and external loans”.