The United States has escalated its tech rivalry with China by rolling out fresh restrictions on semiconductor production, a move that is already rattling global markets and supply chains. The new measures include revoking special export licenses for Asian chipmakers operating in China and threatening tariffs on semiconductor imports from firms that fail to shift manufacturing to U.S. soil.

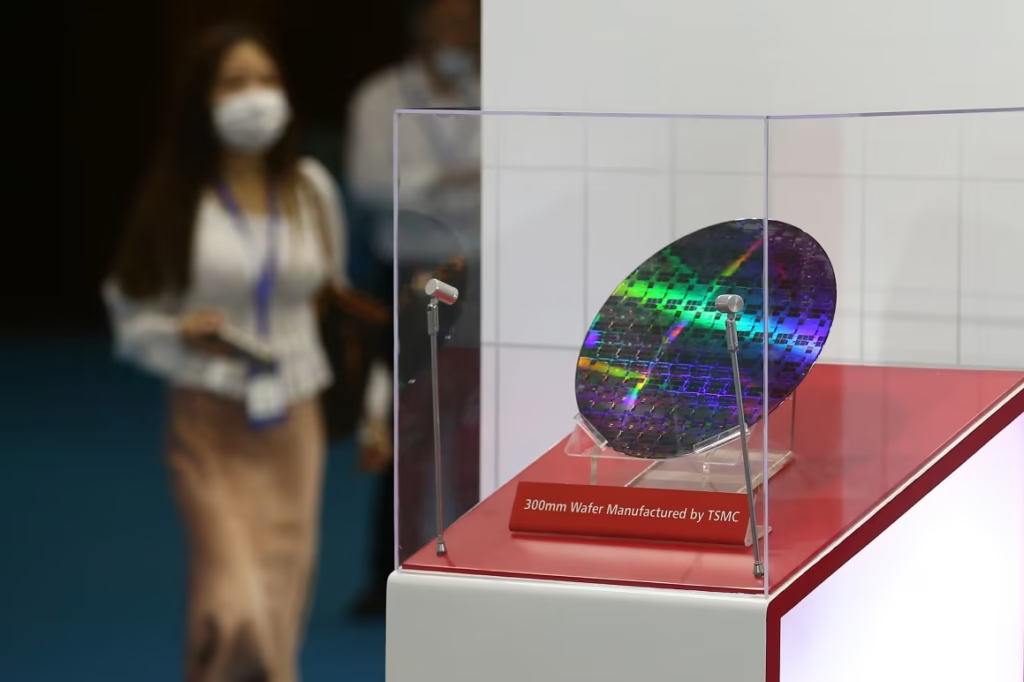

According to officials, the U.S. government will revoke TSMC’s special authorization by the end of 2025, meaning the Taiwanese giant will need to apply for individual licenses to ship chipmaking tools to its factory in Nanjing. South Korea’s Samsung and SK Hynix also lost their exemptions, forcing them to seek U.S. approval for any new or upgraded equipment in their Chinese fabs. The announcement triggered an immediate market reaction, with SK Hynix shares dropping nearly 5% and Samsung falling about 2.6%.

Adding to the pressure, President Trump confirmed plans to impose tariffs on imported chips from companies that do not relocate production to the United States. The policy is designed to push firms like Apple and other major players to expand U.S.-based manufacturing, while giving exemptions to those already investing in domestic plants.

Industry analysts warn these moves could fragment the global chip supply chain. U.S. equipment makers may face declining sales in China, while Chinese firms like SMIC could gain an opportunity to expand as foreign players scale back. Meanwhile, global tech companies are bracing for higher costs, supply disruptions, and a long-term reconfiguration of where—and how—chips are made.

The semiconductor industry sits at the heart of modern economies, powering everything from smartphones to fighter jets. By tightening its grip, Washington is signaling that chips are not just about technology—they’re about national security and economic dominance.